Managing personal finance with Grisbi

|

In Practice

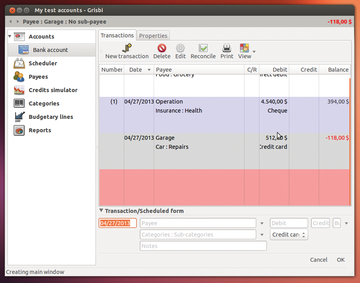

Once configured, you can begin to use the software. In the main view, you see the task on the left and details on the right. The window shows lines of entries for each transaction, including any notes (Figure 3).

Figure 3: In entering a transaction, you can see the details (including any notes) in the right pane.

Figure 3: In entering a transaction, you can see the details (including any notes) in the right pane.

After you've set up your accounts, you generally begin by entering transactions. If, when adding a transaction, you find that an account is missing, you can create the new account at that time, either manually with Edit | New transaction or by importing it from files exported by another financial package. Grisbi provides keyboard shortcuts for certain actions (Table 1).

Table 1

Hotkeys

| Key Combo | Function |

|---|---|

| Ctrl+N | Create new account file |

| Ctrl+O | Open account file |

| Ctrl+S | Save account file |

| Ctrl+W | Close file |

| Alt+R | Show/hide reconciled transactions |

| Ctrl+P | Reconcile/unreconcile account |

| Ctrl+L | Show/hide archived transactions |

| Ctrl+Q | Quit program |

In the second case, you can use File | Import file to start a wizard that leads you through the steps. The program supports four formats: GnuCash (Gnucash), Open Financial Exchange (OFX), the popular Quicken Interchange Format (QIF) [4], and the general CSV (Comma-Separated Value) format used for spreadsheets. These distributed entries are found in the Properties tab of a transaction. Importing spreadsheet formats with CSV files works well as long as the internal format matches. With File | Export accounts as QIF/CSV file , you can export a CSV file from Grisbi to get an idea of the sequence of columns.

If needed, you can sort the data in the spreadsheet. Columns that you don't have in the table, but that Grisbi requires, can be set aside with empty comma-separated entries. If the formats match, export the data. Use semicolons as delimiters instead of commas.

If you don't want to work with existing data but still want to try the program, you can use Grisbi's sample files [5], although the content is in French throughout.

Because the software does not as yet support online banking, you need to enter all transactions manually. Grisbi recognizes the formats from various banks to evaluate the transactions. Income and expenses are entered through the New transaction button.

The first line has the Payee for the transaction, the second has the Category , and the third can contain descriptive Notes . Enter the Debit or Credit amount (in the currency you choose) of the transaction in one of two boxes to the right of the first line.

To be exact, compare the transaction with an actual bank statement [6]. If the transactions match, you can select the transaction and click the Reconcile button at the top (or press Alt+R).

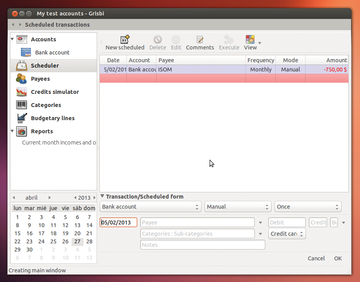

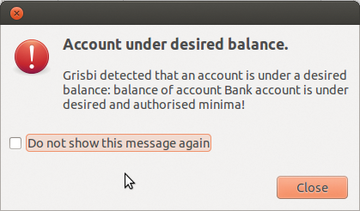

The program is also set up for recurring transactions. The Scheduler lets you enter these transactions and set a frequency in a modified format (Figure 4). If your account turns to a negative balance, a warning appears (Figure 5).

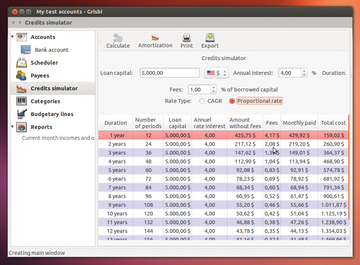

As of version 0.8.9, Grisbi provides a Credit Simulator for credit calculations. To begin, you enter the desired sum and other properties. The main window then shows a table with the credit line data (Figure 6). Note that you can enter the credit timeframes in three different stages in the right-hand corner (e.g., Between 1 and 15 years ).

Figure 6: Grisbi simulates credit transactions. The timeframes fell out of the dialog box in this example.

Figure 6: Grisbi simulates credit transactions. The timeframes fell out of the dialog box in this example.

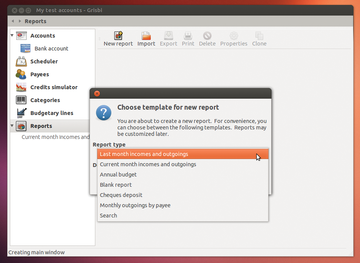

Grisbi provides reports for income and expense balances over time. Choose Reports on the left, and a new set of buttons will appear on the right, including New report . Creating a new report opens another wizard (Figure 7). The application supports various report formats – among them, LaTeX. Unfortunately, although translation of source code currently works for PDFLaTeX, XeLaTex returns the error ! Package utf8x Error: MalformedUTF-8sequence .

Conclusion

One of the big advantages of Grisbi is automatic data backup. You can set the backup interval and create encrypted files. Unfortunately, the program doesn't support online banking, but it's a great help with simple transaction entries. Although entering categories and amounts leaves some room for improvement, auto-completion makes the work easier.

A downside of Grisbi is its minimal flexibility. Users can't add functions that developers have not anticipated or that weren't implemented, which is possible in a spreadsheet application. If you want double-entry bookkeeping, GnuCash [7] might be a more viable alternative.

Infos

- Grisbi: http://www.grisbi.org

- Wiki (English): http://wiki.grisbi.org/doku.php?id=docs_en:faq

- Manual (French): http://iweb.dl.sourceforge.net/project/grisbi/Documentation/manual_0.8.9/grisbi-manuel-img-0.8.9.pdf

- Import/export QIF and OFX files: http://wiki.grisbi.org/doku.php?id=docs_en:importing_exporting_qif_and_ofx_account_files&s[]=online

- Sample data: http://sourceforge.net/projects/grisbi/files/Documentation/examples/

- Bank reconciliation: http://wiki.grisbi.org/doku.php?id=docs_en:bank_reconciliation

- GnuCash: http://www.gnucash.org

« Previous 1 2 Next »

Buy this article as PDF

Pages: 5

(incl. VAT)